[This is the third of a four-part series focused on the Rutgers Institute for Corporate Social Innovation’s “Four Pillars of Corporate Social Innovation.”]

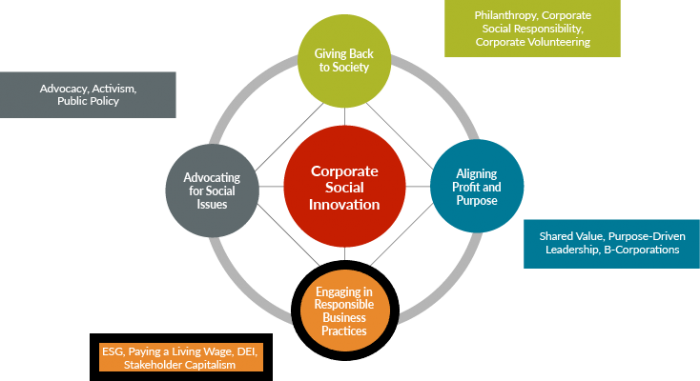

In this series, we frame our journey for the success of both business and society in the context of a new, four-pillar model of Corporate Social Innovation.

Engaging in Responsible Business Practices: when firms manage their activities with accountability for positive impact for all stakeholders

Given the enormity of the ‘wicked problems’ facing humanity today, many companies, governments, nonprofit organizations, and institutions of higher education are stepping up to the challenges in well-intended but often ineffectual ways. One thing that has become apparent is that the old business models where maximizing shareholder wealth is the main or only thing that matters are no longer tenable. In its place we have new business models emerging, including: Stakeholder Capitalism, Environmental/Social/Governance (ESG); a strong emphasis on Social Justice, including the need to pay a living wage; and an approach to business that deeply embeds Diversity, Equity, and Inclusion (DEI) in its values and all its business policies and practices.

Here I will briefly introduce each of these components, noting that they are all inextricably intertwined and absolutely necessary to drive responsible business. Even so, while these efforts may be necessary and are certainly laudable, they may not be entirely sufficient. In all this work, what is abundantly clear is that we need to take an intentional Systems Approach to drive the deep seated transformation of business purposes and practices at the scope and scale that is required. As Sandra Waddock said in this article, these “changes require vision, leadership, and courage from leaders in businesses and leaders in the public square.”

- Stakeholder Capitalism

One example of a visionary leader driving systemic change at scale in the financial markets is Blackrock’s CEO Larry Fink who in his 2020 and 2021 letters to CEOs made sustainability and climate related investments paramount, potentially affecting $7 trillion in investments.

Similarly, the Business Roundtable (BRT), representing 181 Fortune 500 CEO signatories in 2019, had tremendous potential to drive systems change through its restatement of the very purpose of business, through its declaration that they are committed to leading their companies for the benefit of all stakeholders – customers, employees, suppliers, communities and shareholders. Today, this is coming to be widely known as stakeholder capitalism.

Walmart provides another example of systemic change, as it requires all its one hundred thousand suppliers to adopt high sustainability standards and adhere to its sustainability scorecard.

At the government level, systemic changes are being driven in the U.S. by the Securities and Exchange Commission (SEC), which is actively seeking public input on whether current disclosures about climate change adequately inform investors. And the U.S. Congress just passed sweeping legislation, including climate disclosure rules requiring public companies to report environmental, social and governance (ESG) metrics.

At the global level, to truly drive systemic change, we would need to replace GDP as the ultimate measure of economic progress with broader metrics such as the Genuine Progress Indicator (GPI) at the societal level.

- Environmental, Social and Governance (ESG) Factors Driving Change

Environmental, Social and Governance (ESG) factors, or sustainable investing, represents a rapidly growing trend driving large-scale change in the financial community.

“The finance industry, by nature of its privileged position in the allocation of global capital, can make a potentially disproportionate impact on addressing the world’s challenges.” Capital as a Force for Good,

The Force for Good initiative launched by the UN in 2020 with active participation of such companies as Bank of America, Blackrock, Citi, Credit Suisse, JP Morgan Chase, Morgan Stanley, et al., is now characterized as a “race to the top” with trillion dollar investments. Leading financial institutions are aligning behind the SDGs, moving beyond ESG from solely a risk perspective, and are proactively stepping in to fill the gaps in governments’ agendas.

As of December 2020 in the US, $12.5 trillion or 12% of total assets were actively incorporating ESG factors in investment decisions to promote activities and drive positive change related to the SDGs. This is expected to hit $53 trillion by 2025. It’s fair to say that ESG is now firmly ensconced in the mainstream of corporate America, and is a frequent topic in boardrooms, C-suites, investor meetings, and regulators’ comments.

While environmental sustainability has been the major focus of ESG, the pandemic and social unrest have catapulted the “S” (social) into greater focus with increased stakeholder expectations for public disclosure of safety, health, and Diversity, Equity, and Inclusion (DEI) metrics. The twin themes of climate change and racial equity, which came acutely into focus in 2020 in shaping ESG investing, are expected to continue to play a prominent role going forward.

ESG metrics, which are fast becoming a business imperative, represent a very significant trend driving towards responsible business. As companies are increasingly held accountable for ESG risks, they will be expected to disclose them in more detail as consumers, NGOs, employees and investors push the industry towards stakeholder capitalism.

Despite these advances, ESG has yet to be mainstreamed in internal corporate governance and operations at the individual company, manager, and employee level. We believe to actualize ESG’s full potential for systemic change, employees in all functions and at all levels need to be educated to understand and leverage its power, not just in the boardroom. And at the middle and senior levels, a wide spectrum of managers need to understand how to identify, measure, and evaluate ESG risk exposure, as well as opportunities for shared prosperity and inclusive growth.

On a positive note, ESG is opening up many exciting career opportunities for professionals. According to Joel Makower, Chairman & Co-Founder, Greenbiz Group, “It's a good time to be an ESG professional. A very, very good time.” We’re seeing booming demand for ESG experts in many fields, including not only finance and investment firms, but also in management consultancies, advisory firms, real estate companies, NGOs, business associations, and in many thousands of companies needing to report their ESG data to their stakeholders. And once the data is compiled these organizations need people to help fully embed the findings in their strategies and operations. The projected need for talent is so great that PwC recently announced a $12 billion plan to create 100,000 new jobs in ESG by 2026.

Moreover, according to the Weinreb Group (specialists in sustainability recruiting) more companies hired their first CSO in 2020 than in the previous three years combined. And while the number of women in CSO roles has almost doubled, with women now accounting for 54% of CSO positions, of concern is that the CSO role remains overwhelmingly white.

- What is DEI and Why Does it Matter to Business?

In our view, Diversity, Equity, and Inclusion (DEI) are not just buzzwords; they underpin Corporate Social Innovation. The RICSI explores how, through the lens of “multiple diversities” — a framework that encompasses many unseen DEI factors – we can achieve more meaningful belonging. In her recent HBR article RICSI Executive Director Noa Gafni advocates expanding the traditional definitions of diversity, such as race, gender, ethnicity, and sexual orientation, to include age, socioeconomic status, and lived experience.

Research has shown the extensive difference it can make when companies engage the whole system, with its diversity of stakeholders, in the conversations at work. For example, when employees are fully engaged, companies see a 60% improvement in performance and employees are 87% more likely to remain within the organization. Even more, research points to a 1000 percent increase in ROI over a ten year period. The companies fully engaging their employees benefit from greater loyalty, innovation and performance.

As my colleague Distinguished Professor Nancy DiTomaso points out, creating a diverse, equitable and inclusive organization is more easily said than done. She argues persuasively that we must take an historical, institutional, and structural view that looks at how the present is shaped by what has happened in the past. By focusing on the historical embeddedness of diversity through processes of institutionalization, we see how diversity has always been associated with hierarchical inequity.

“The racial hierarchy that exists both in belief systems and structures and institutions still has a legacy in the present, and failing to acknowledge this helps explain why diversity, equity, and inclusion programs have not made as much of a difference as they should have after decades of effort.” (p.12).

- Why should companies pay a living wage?

Paying workers a living wage is essential to being a Responsible Business. The Living Wage Network formed in 2018 now comprises over 2,500 small and medium sized U.S. businesses that have certified their willingness to pay a living wage to their employees. This means their employees don’t need to work multiple jobs just to make ends meet, or take on crippling debt, or have to ask friends and family for money just to survive. While paying people living wages allows people to spend time with their families, a good thing for society overall, the ripple effect extends to the entire community, and even to the industries within which people work. The economic effects are substantial, as a living wage allows people to more fully participate in the local economy, using their purchasing power to drive sustainable prosperity and inclusive growth. It also broadens the tax base, enabling local, state, and federal governments to invest in services and infrastructure to strengthen the local economy overall.

Conclusion

In the past year, despite the pandemic and myriad problems all around us, we have seen great strides and signs that we are moving in a positive direction. Here I synthesized multiple trends indicating that we are moving with alacrity towards Sustainable Capitalism, with the support of a booming ESG industry, and significant commitments to driving greater diversity, equity and inclusion.

Despite these positive signs, the challenges and wicked problems we face require systems thinking and a multi-sector approach. Business needs to work closely with government to find systemic solutions that can accelerate the needed changes at scale through corporate social innovation, visionary and transformational leadership.

Be sure to check out our next blog in the CSI series focused on “Advocating for Social Issues” and featuring such companies as Public Service Enterprise Group (PSEG), Ben & Jerry’s, Glassdoor, and Microsoft.